Stock Trading

Started with $1,500. Doubled in six months.

[trade stocks] and I did it well. No options. No guru signals. Just timing, risk control, and discipline.

Then built a rules-based system to repeat it. I learned trading and I did it well. No options. No guru signals. Just timing, risk control, and discipline.

How I Got Started Swing Trading - I Started at Work

Claims adjuster by day. Lunch-hour trader by choice. Built a watchlist, hunted momentum, locked into swing trading. Doubled my account in six months. Then I sold positions to fund education until I closed the loop on the missing piece. After that, I repeated the results for 4+ years.

The Stress Test: CNBC Portfolio Challenge

I tested my general strategy against about 500K other traders in the CNBC Portfolio Challenge. The challenge forced end-of-day market orders—no intraday limits, no automated stops. Under those constraints, I still returned 69% in ~60 days (top ~2%). Doing it the ‘hard way’ made the discipline stick.

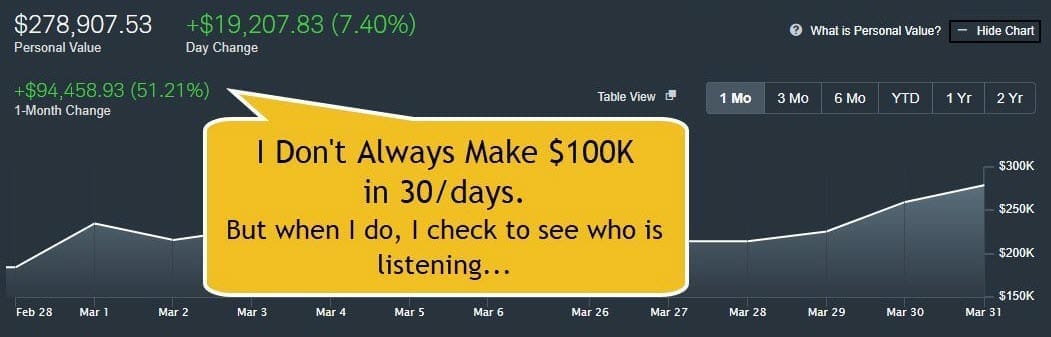

The Crisis Test: Managing the Crash I took over a family portfolio during COVID after it fell from $300K to $200K. I pushed for active risk management, not passive ‘long haul’ talking points. In my experience, ‘we’re in it for the long haul’ is often code for "I don't know how to manage downside risk."

Why I Am Not Licensed (By Choice) I considered getting licensed (Series 6/63/7), but I realized the exams certify compliance, not competence. Passing a test allows you to read a disclaimer to a client; it doesn't teach you how to execute a trade.

I refused to get certified just to sell products I didn't believe in. Many advisors collect 1–2% a year to "manage" money that they never actually move. My stance is simple: No one cares more about your money than you do. I don't want to manage your money; I want to show you the system so you can manage it yourself.

The Discord Experiment Frustrated with the lack of transparency in the industry, I launched a Discord channel to show my work in real-time.

No Marketing.

No Monetization.

Just Transparency.

I put my own capital on the line. When I made a "call," it wasn't theory—I had $10K or more of my own skin in the game. I hosted day-traders, swing-traders, and long-term investors in one hub. Eventually, I realized you don't need to be "all things to all people." You just need to do one thing remarkably well.

Proven System

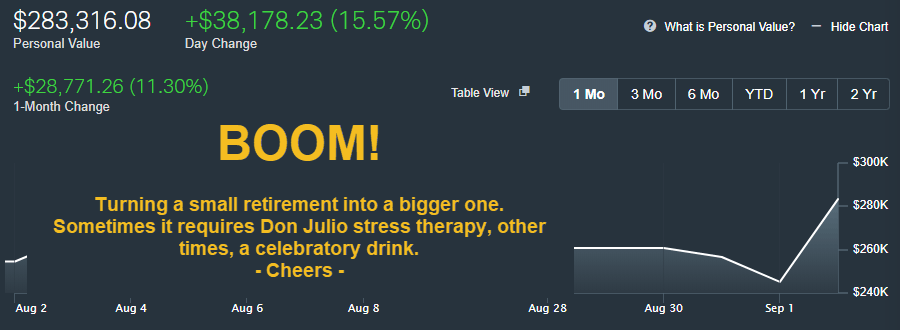

This is a rules-based swing-trading system. Entries, exits, risk defined up front. I can’t promise you’ll double your money—your account size, risk tolerance, and discipline matter. But I can promise a clear framework that’s been tested and applied in the real world.

The Transition to Pure Technicals

While the Discord community was valuable for transparency, I realized that chat rooms often create noise. I didn't want to rely on "alerts" or social hype. I wanted a system that worked in silence.

I shut down the noise to focus purely on the Price Action. The image below isn't a "prediction"—it is a risk map. My system relies on identifying specific technical patterns, setting a hard stop-loss, and letting the math play out.

Free PDF Downloads

Downloading the Swing Trading Watchlist — curated swing-trading checklist and process.

Chris Daniel

I am a Claims Adjuster and Network Admin focused on Strategy & Systems Analysis. Basically, I investigate everything until I figure it out. From IT networks and insurance policies to stock market momentum, social media algorithms, and litigation tactics—I treat every challenge like a crime scene to be solved. (And no, it's not always Colonel Mustard with the Candlestick in the Living Room)

About page.

Food For Thought

“Don’t let the opinions of the average man sway you. Dream, and he thinks you’re crazy. Succeed, and he thinks you’re lucky. Acquire wealth, and he thinks you’re greedy. Pay no attention. He simply doesn’t understand.”

- Robert G. Allen

- This quote reminds me to stay focused on my goals, no matter what others think. Success often comes from doing what others won’t.

All Rights Reserved.